The Satellite Industry in a Post-Pandemic World

by Virgil Labrador, Editor-in-Chief

Los Angeles, Calif., September 6, 2021--As with many industries, the satellite industry has not been spared the effects of the global COVID-19 pandemic which hit the world over a year and a half ago. The pandemic has drastically disrupted supply chains and practically shut down key market segments for satellite such as in-flight connectivity and some key segments of the maritime sector such as the cruise ship business. Some key installations and contracts were delayed due to travel restrictions. However, the satellite industry has fared better than most industries during the pandemic due to several factors inherent in the key markets that the industry serve and the prospects post-pandemic are encouraging.

At the beginning of the pandemic in the first quarter of 2020, the satellite industry was hit by some high profile bankruptcies which involved the second largest satellite operator Intelsat and Low Earth Orbit (LEO) operator OneWeb. OneWeb have since received fresh capital investment and emerged from bankruptcy while Intelsat is on track to exit bankruptcy by the end of the year. In the case of Intelsat, it has since started to acquire companies such as Gogo Aviation, betting on the swift recovery of the aviation market. If anything, the high profile bankruptcies of satellite companies during the intial stages of the pandemic was not directly a result of the pandemic but for causes that pre-existed the pandemic.

Increased Financial Activity

Since last year there has been no other major bankruptcies in the satellite industry and it has actually been seeing increased Mergers and Acquisitions (M&As) and investment activities.

A key development since the pandemic has been the rise of Special Purpose Acquisition Companies (SPAC) which made it easier for startup companies with limited financial or opreational track records to raise capital by Initial Public Offering (IPO). In 2020, over US$ 3 Billion were raised by SPACs for space-related companies. While SPAC activity has slowed a little since last year due to tighter regulations, some analysts view the increased interest in space companies in the investment community will result in the influx more private equity investment in the industry.

Short- and Long-Term Industry Prospects

The latest figures from the Satellite Industry Association (SIA), which tracks the health of the industry through its annual “State of the Satellite Industry” report reveals continued strength and growth in the global space economy in 2020, despite the pandemic. "The industry’s investment in technology and innovation led to improved affordability and productivity, enabling new capabilities, and opening up new markets. The commercial satellite industry in particular saw record-setting growth in the number of satellites launched," according to the report.

Among the highlights of the SIA report include:

Among the highlights of the SIA report include:

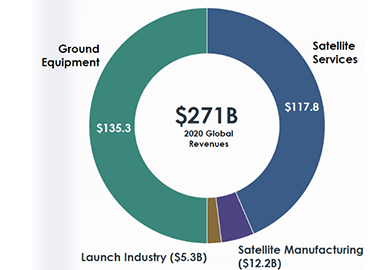

The global space economy grew 1.4% to US$ 371 Billion from 2019 to 2020. Satellite industry accounts for 73% of space economy revenues worldwide.

Ground equipment segment grew to US$135.3 Bil. in total revenue for the year–reflecting the rise in consumer broadband, on-the-move connectivity, and satellite-enabled smartphones and other devices.

Satellite broadband revenue grew by 10 percent during 2020 to US$ 2.8 Billion due to technology innovations that increased data capacity and number of subscribers.

The growth of the satellite industry during the pandemic continues in the first half of 2021. The industry has already launched 1,200 satellites in the first half of 2021, matching the total number launched during all of 2020.

The prospects are very good for the industry in the long-term as well. Numerous studies are projecting continuous growth for the industry across all segments through the end of the decade.

Just to highlight some of the key studies, NSR is projecting that 24,700 new satellites will be launched through the end of 2030. A great majority of those satellites are in the non-GEO orbits.

By all indicators, the Low-Earth Orbit (LEO) satellite constellations will be dominating the industry though this decade. LEO constellations will be fuelling growth in various satellite vertical markets such as Broadband Access, Enterprise, Internet of Things (IoT), Cellular Backhaul, among others.

The key factors that served the satellite industry well during the pandemic and in the post-pandemic economy are inherent in the types of services that satellite provides. Satellite technology is a key enabler in provide connectivity and in the post-pandemic world--most of the key economic drivers will require connectivity and lots of it. In fact, of the 10 Technology trends to watch post-pandemic according to the World Economic Forum, seven of them presents unique opportunities for the satellite industry. These include increased demand for bandwidth to facilitate the following:

- Online shopping

- Digital & contactless payments

- Remote work

- Distance Learning

- Telehealth

- Online Entertainment

- Automating the supply chain

All of the above will require broadband connections which can involve satellite technology. So, the post-pandemic prospects for the industry are looking very good indeed.

Conclusion

Without a doubt, life as we know it has been drastically changed by the global COVID-19 pandemic. With increased rates of vaccinations, signs are very encouraging that the worse will be over by 2022. But there is a lesson to be learned from all the pandemics that have seen in the last two decades alone: pandemics may be here to stay.

The important thing is how to mitigate the devastating effects of pandemics. As in any crucial challenge that we face in the past, it's important to learn the lessons well and prepare for the next set of challenges. A lot of the satellite companies that I have interviewed recently have made very good use of their time during the pandemic by streamlining their operations and supply chains to make them "pandemic-proof." Some have ramped up their Research and Development (R&D) efforts and developed innovative new products.

Those companies that have made good use of their time during the pandemic doing forward-looking things are well-poised to face the future, which from most indicators seem quite positive for the satellite industry.

----------------------------------------

Virgil Labrador is the Editor-in-Chief of Los Angeles, California-based Satellite Markets and Research which publishes a web portal on the satellite industry www.satellitemarkets.com, the monthly Satellite Executive Briefing magazine and occasional industry reports called MarketBriefs. Virgil is one of the few trade journalists who has a proven track record working in the commercial satellite industry. He worked as a senior executive for a teleport in Singapore, the Asia Broadcast Center, then-owned by the US broadcasting company CBS. He has co-authored two books on the history of satellite communications and satellite technology. He holds a Master’s in Communications Management from the University of Southern California (USC). He can be reached at virgil@satellitemarkets.com

Virgil Labrador is the Editor-in-Chief of Los Angeles, California-based Satellite Markets and Research which publishes a web portal on the satellite industry www.satellitemarkets.com, the monthly Satellite Executive Briefing magazine and occasional industry reports called MarketBriefs. Virgil is one of the few trade journalists who has a proven track record working in the commercial satellite industry. He worked as a senior executive for a teleport in Singapore, the Asia Broadcast Center, then-owned by the US broadcasting company CBS. He has co-authored two books on the history of satellite communications and satellite technology. He holds a Master’s in Communications Management from the University of Southern California (USC). He can be reached at virgil@satellitemarkets.com