The Most Significant Satellite Stories of 2019

by Elisabeth Tweedie

Los Angeles, Calif., December 30, 2019--Trying to choose the most significant stories of the year, is always a challenge! Is x more important than y and does z really have an impact? Inevitably, the choice of topics to include will always be subjective. So, here’s my short list.

Firstly, Low Earth Orbit Satellites (LEOs): the good and the not so good. We’ve been hearing about them for years and every year the number of filings increases. The current number is in excess of 150. However, in 2019 several of the better-known constellations started launching, moving at least one step closer to reality. OneWeb launched its first six satellites in February and was planning to launch more in December, but the second launch has been delayed until January next year. Monthly launches of at least 30 satellites are planned for 2020. It is planned to start offering service in the Artic towards the end of next year.

After two launches, SpaceX now has 120 of its Starlink satellites in orbit. It plans to continue with regular launches next year, and start service in the USA in mid-2020 when a total of 6-8 launches will have been completed. However, as yet, there is no final design for the consumer terminal, so it is likely that initial service will be focused on government users. Data connectivity of 610 Mbps has been demonstrated to U.S. military aircraft. SpaceX has also filed with the ITU for 30,000 satellites, in addition to the 12,000 already filed for.

Compared to the numbers of satellites planned, 126 launched is a pretty small number, but it is one step closer to reality. There are however many boxes to be ticked before we have an operational service. Affordable antennas, user terminals, landing rights, distribution, frequency coordination, to mention just a few….oh and financing of course. The latter looks to have proved an insurmountable hurdle for LeoSat when it’s first two investors withdrew. This is particularly significant, as LeoSat was going after commercial customers and already had signed commitments to the tune of US$2 billion, proving that there is nothing as fickle as investors.

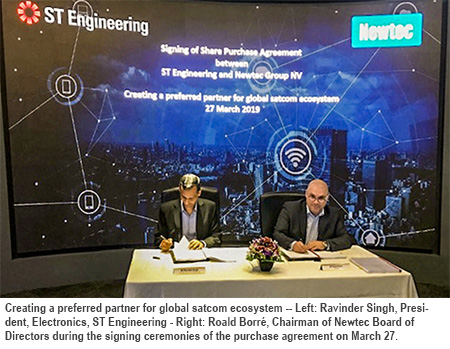

In March of this year, ST Engineering, owner of iDirect, announced its planned acquisition of Newtec. This acquisition was finalized on October 1st. Newtec is now known as ST Engineering (iDirect) Europe, NV. Thomas Van den Driessche, previously Chief Executive Officer (CEO) of Newtec, is now President of the Executive Strategic Board & Chief Commercial Officer of the combined companies. In this role he will lead the newly-formed Strategy Group which comprises product lifecycle management (PLM), vertical market development, marketing and strategic business development. Frederik Simoens, previously Chief Technology Officer (CTO) of Newtec, is now CTO of the combined company.

In March of this year, ST Engineering, owner of iDirect, announced its planned acquisition of Newtec. This acquisition was finalized on October 1st. Newtec is now known as ST Engineering (iDirect) Europe, NV. Thomas Van den Driessche, previously Chief Executive Officer (CEO) of Newtec, is now President of the Executive Strategic Board & Chief Commercial Officer of the combined companies. In this role he will lead the newly-formed Strategy Group which comprises product lifecycle management (PLM), vertical market development, marketing and strategic business development. Frederik Simoens, previously Chief Technology Officer (CTO) of Newtec, is now CTO of the combined company.

In the last ten years or so, Newtec has grown from a relatively minor player in the ground segment, to a major force to be reckoned with. Although its focus was originally on the broadcast segment, whereas iDirect is better known for its dominance of the maritime market; in the last few years, since the introduction of Newtec Dialog, on more than one occasion, I’ve heard iDirect customers admit that they were considering Newtec for future purchases.

Acquisitions of a small company by a significantly larger one, can have two outcomes. The smaller company gets “swallowed,” staff get laid off and the innovation that got the small company to where it is, all but disappears. Alternatively, the smaller company gets an injection of cash, to foster future innovation and the best of both companies is preserved. The company is now in the consolidation phase “conducting a joint deep dive” into the combined products and technologies, so it will be 2020 before we know the full impact on the product line of both companies. However, initial signs are positive and everyone I’ve spoken to at Newtec is enthusiastic about the new company.

The next two stories are about Tom Choi and his latest endeavors. We all know Tom as the founder and outspoken former CEO of ABS. Since leaving ABS Tom founded Airspace Internet Exchange (AirspaceIX). This company currently has two subsidiaries. Saturn Satellite Networks and Curvalux.

Saturn is a builder of small (600 to 1,1700 kilograms) geostationary (GEO) satellites, known as Nationsats. As would be expected from the name, the target market is small nations that do not have their own satellite. Ideally nations that can’t afford to roll out fiber or 4G, and require a national footprint to provide broadband. According to Choi, a nationsat can provide 60-80 gigabits per second capacity. The first satellite is due for delivery in 2020. In September, Saturn announced plans to acquire a California based company, NovaWurks. NovaWurks has developed modular satellites, known as Hyper Integrated Satellites (HISats), and has conducted a demonstration for the US Defense Advanced Research Projects Agency (DARPA).

Curvalux is described as a multi-beam phased array wireless broadband access and backbone technology. The stated target is to be 10x to 100x faster than current wireless technology and 10x to 1000x cheaper than current platforms. It currently operates in the 5GHz unlicensed band, but it is planned to also make the technology available in the 2-3GHz licensed bands. The same frequencies that will be used for low-band 5G in some parts of the world. Field trials were conducted with Curvalux earlier this year. In Manila, fixed user terminals achieved speeds of over 2Gbps, and in Las Vegas a WiFi 6 (also known as 802.11ax) enabled smartphone located 800 meters from the tower achieved a 400Mbps connection. According to the website, it is intended that connectivity will be achievable at a distance of 15 kilometers from the tower for a fixed connection and 2 kilometers for a mobile device.

When Tom spoke at World Satellite Business Week, in Paris this year, he talked about combining Curvalux with Nationsat to provide low-cost broadband to unserved areas of the world. It will come as no surprise to anyone who has heard Tom speak in the last few years, to hear that this is something he believes he can provide far more efficiently than any of the LEO constellations. If he is correct, not only will he be challenging the satellite industry, he will also be taking on the wireless industry.

The C-Band Alliance formed by Intelsat, SES, Eutelsat and Telesat was dealt two separate blows this year. Firstly, Eutelsat departed the alliance saying that its voice wasn’t been heard, then in spite of promises by the alliance to put funds into rural 5G in the US, on November 18th the FCC declared that a public auction would be used to release the bandwidth. The alliance had intended to run a private auction, thereby benefitting from giving up the spectrum. The C-Band alliance was always contentious, and its aims vehemently opposed by many other satellite operators. It is a matter of opinion whether the motive was simply financial gain, or an attempt to have some control over what many regard as an inevitable event, i.e. the loss of some C-Band spectrum to the mobile industry. No matter what the motive, the decision by the FCC caused a 75% drop in Intelsat’s share price and nearly a 30% drop in SES’.

SpaceX revolutionized the launch industry, firstly by undercutting the price of existing providers and then by demonstrating great skill in reusability. Relativity space is poised to revolutionize the launch industry again, but in a different manner. Its rockets are built entirely by 3D printing. The shell can be built in 25 days and the complete rocket in 60 days. As Tim Ellis, CoFounder and CEO Relativity Space said at Satellite Business Week, this means that we can improve the design of the rocket every 60 days. The company has raised US$185 million to date. US$140 million of which came in this October for Series C financing. According to Jordan Noone, co-founder and chief technology officer (CTO) Relativity now has sufficient capital to complete development of the rocket, and begin commercial operations in 2021, as well as fund the expansion of its headquarters and establish a factory for rocket production in Mississippi. If all goes as planned, the possibility to launch two months after signing the contract is a huge change for the industry. The target price is under US$6000 per kilogram. Contracts have been signed with Telesat for its LEO constellation and with Momentus. The contract with Momentus enables Relativity to offer service to geostationary transfer orbit (GTO). Momentus is another startup and one that aims to provide in-space transport, moving satellites from an ISS orbit to other orbits including GEO.

No article on the important stories of 2019, would be complete without a mention of WRC 19. This is the World Radiocommunications Conference held every four years to make decisions on spectrum usage and allocation. The conference will be attended by over 3,500 participants from 193 ITU member states, as well as observers from private sector members and members of international organizations. There are several issues on the agenda relevant to the satellite industry. The one that has garnered the most attention is the allocation of millimeter waves for 5G. Given that this happens to include spectrum used for Ka-Band this is hardly surprising. The GSMA (GSM (Global System for Mobile communications) Association) is asserting that US$565 billion of global economic expansion is at risk, if the mobile operators don’t have access to this spectrum. Interestingly the delegates are divided on this issue. Europe is seeking to constrain usage claiming potential interference with some satellite services. The US, along with Africa and Arab nations, on the other hand, wants to authorize usage for 5G pointing to studies that indicate that 5G usage of mmWave spectrum can safely coexist with satellite services. One of the arguments used by the GSMA is that the fastest 5G speeds have been obtained in the US where mmWaves are being used for 5G. This argument fails to point out, that mmWaves don’t travel very far, necessitating a significant increase in the number of base stations needed, nor does it make any mention of the fact that these frequencies don’t penetrate buildings, limiting these faster speeds to outdoor areas only. As well as Ka-Band, usage of the Q and V-Bands are also on the agenda. 5G is of particular interest to the operators of teleports located in urban areas, who will need to take steps to shield antennas from 5G spillover.

Other topics on the agenda of interest to the satellite community include: the introduction of deployment milestones for the large constellations, the establishment of a regulatory framework for “short-duration” satellites. i.e. those that orbit for less than three years. New regulations were put in place at WRC for the filing of new LEO and MEO constellations (or Non-GEO systems). As with GEO satellites, LEO and MEOs will have a window of time to launch their satellites in order to maintain their orbital positions. Under the newly adopted regulatory approach these systems will be required to deploy 10 per cent of their constellations within two years from the end of the current period for bringing into use, 50 per cent within five years, and complete the deployment within seven years. These new regulations will certainly narrow dow the filed for upcoming LEO and MEO constellations.

Whatever the outcome of WRC 19, it is inevitable that the battle for spectrum between the satellite industry and the mobile operators will continue into WRC 23.

-----------------------------------------

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com