NSR Report: Maritime VSAT Connectivity Reaches Tipping Point, to Exceed 75,000 VSAT-enabled Vessels by 2028

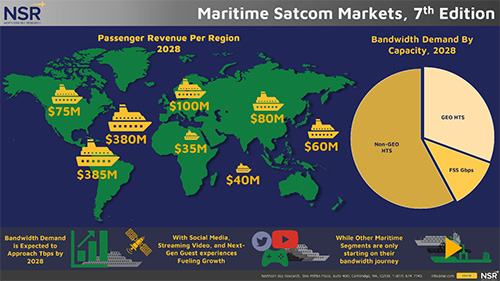

Cambridge, MA, July 10, 2019 — NSR’s Maritime Satcom Markets, 7th Edition report, published recently, forecasts VSAT-enabled Maritime vessels to grow from over 20,000 vessels in 2018 to over 75,000 by 2028. Generating almost US$ 42 billion in cumulative revenues between 2018 – 2028, the Maritime satcom connectivity market has never looked more promising.

“Setting aside some weakness in the Offshore Oil & Gas Sector, the Maritime connectivity markets are moving in high-gear,” states Brad Grady, principal analyst and report author. “The right combination of price, end-user requirements, and connectivity demand is having a significant impact on the market. With new investments across the throughput spectrum, there is one clear message – a significant part of the maritime market has become unlocked for broadband satellite connectivity. Falling capacity prices in addition to lower equipment costs have opened the next-tier of Maritime end-users, accelerating adoption rates, and unlocking more vessels. FSS and MSS will play pivotal roles in generating retail revenues, but HTS from GEO and Non-GEO is the growth story.”

Each market will provide unique advantages across the Maritime satcom value-chain. For Satellite Operators, the Passenger markets (Ocean and River Cruises, Ferries) will require truly massive amounts of connectivity – exceeding 870 Gbps by 2028. For Service Providers, Merchant vessels are adopting VSAT connectivity at unprecedented rates, adding over 40k vessels between 2018 to 2028.

Each market will provide unique advantages across the Maritime satcom value-chain. For Satellite Operators, the Passenger markets (Ocean and River Cruises, Ferries) will require truly massive amounts of connectivity – exceeding 870 Gbps by 2028. For Service Providers, Merchant vessels are adopting VSAT connectivity at unprecedented rates, adding over 40k vessels between 2018 to 2028.

For Equipment manufacturers, Fishing and Leisure markets are expected to post some of the best growth rates for equipment revenues, at almost 8% and over 12% CAGR between 2018 – 2028, respectively. Offshore Oil & Gas, however, will continue to face near-term challenges, but by 2028 will show some signs of positive revenue growth.

Bottom Line, with a forecast of over $5.3 Billion in Retail Revenues by 2028, smooth waters are ahead for Maritime satcom connectivity.

NSR’s Maritime Satcom Markets, 7th Edition is built from 10 plus years of research on the maritime satellite communications market. Continuously tracking the developments of key players, end-users, and market segments; combined with extensive interviews across the value-chain, the report forms a complete quantification of major trends, drivers, and restraints in the maritime satcom market.

NSR is a global market research and consulting firm focused on the satellite and space sectors. First to market coverage and a transparent, dependable approach sets NSR apart as the key provider of critical insight to the satellite and space industries.