Telesat Reports Results for the Quarter Ended March 31, 2025

Ottawa, Canada, May 6, 2025 – Satellite operator Telesat (Nasdaq and TSX: TSAT) today announced its financial results for the three month period ended March 31, 2025. All amounts are in Canadian dollars and reported under IFRS® Accounting Standards unless otherwise noted.

“I am pleased with our performance in the first quarter of this year, including our disciplined execution in our GEO business and the excellent progress we are making on the Telesat Lightspeed technical and commercial fronts,” commented Dan Goldberg, Telesat’s President and CEO. “ Our recently-announced contract with Viasat, along with the Orange and ADN agreements we announced earlier this year, are clear evidence of the strong market response we are seeing to the Telesat Lightspeed offering. Our LEO backlog2 is now nearly CDN$ 1.1 billion, and we continue to believe that our year-end 2025 LEO segment backlog will exceed our year-end 2024 GEO segment backlog.”

Goldberg added: “In our GEO segment, through focused execution we generated a 74% Adjusted EBITDA margin1 and ended the quarter with a substantial contractual backlog of CDN $1.0 billion. We remain confident in the 2025 guidance we released on our last earnings call.”

All amounts below are in Canadian dollars and reported under IFRS® Accounting Standards unless otherwise noted.

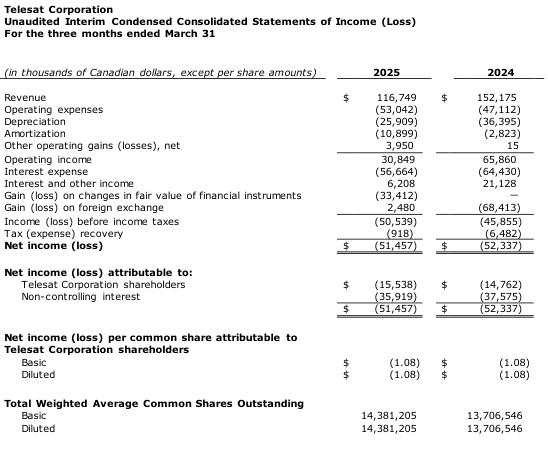

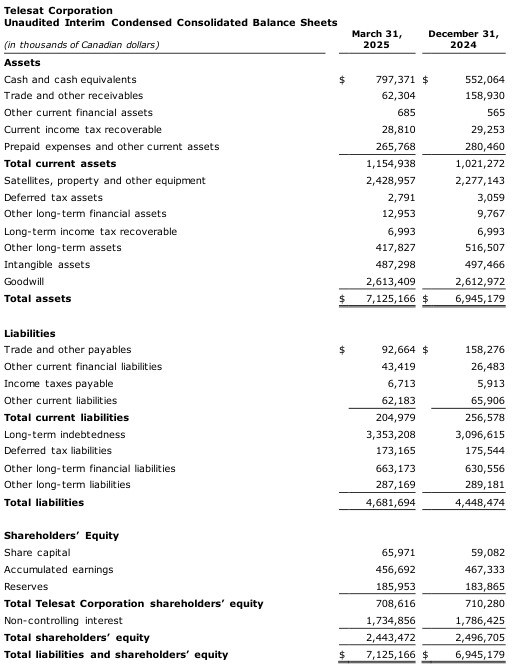

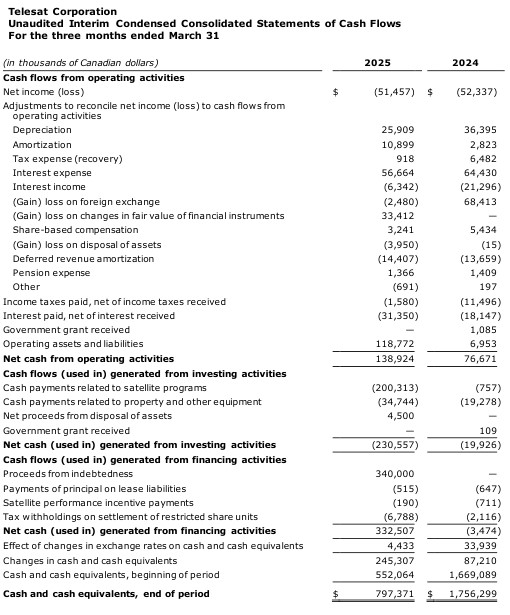

For the quarter ended March 31, 2025, Telesat reported consolidated revenue of $117 million, a decrease of 23% ($ 35 million) compared to the same period in 2024. When adjusted for changes in foreign exchange rates, revenue declined 26% ( $ 40 million) compared to 2024. The decrease was primarily due to a lower rate on the renewal of a long-term agreement with a North American direct-to-home television customer and to reductions in services for certain customers, particularly on an agreement to provide services to an Indonesian rural broadband program, combined with lower equipment sales to Canadian government customers.

Operating expenses for the quarter were $53 million, an increase of 13% ( $6 million) from 2024. When adjusted for changes in foreign exchange rates, operating expenses grew 10% ($4 million) compared to 2024. The increase was primarily due to headcount growth for Telesat Lightspeed and higher legal and professional fees, partially offset by higher capitalized engineering, lower consulting costs related to our LEO consulting revenue, and lower share-based compensation.

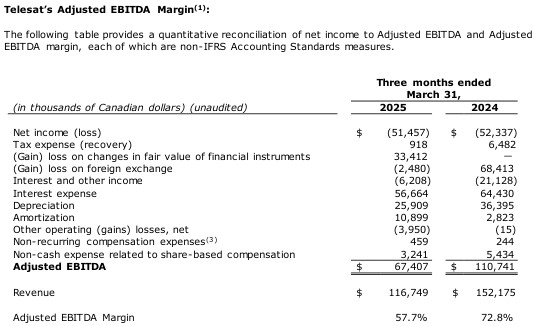

Adjusted EBITDA1 for the quarter was $67 million, a decrease of 39% ($43 million) or 42% ($46 million) when adjusted for foreign exchange rate changes. The consolidated Adjusted EBITDA margin1 was 57.7%, compared to 72.8% in the same period in 2024.

Telesat’s net loss for the quarter was $51 million compared to a net loss of $52 million for the same period in the prior year. The change was primarily due to a gain on foreign exchange in the first quarter of 2025 compared to a loss in the first quarter of 2024, offset by lower revenue and a loss related to an increase in the fair value of the Telesat Lightspeed financing warrants.

Business Highlights

-

Telesat Lightspeed Commercial Agreements

-

-

In April, Telesat signed a multi-year agreement with Viasat Inc. for Telesat Lightspeed services, under which Viasat, the largest broadband connectivity provider in the commercial aviation market, will integrate Telesat Lightspeed into their services portfolio for aviation, maritime, enterprise, and defense markets.

-

-

-

In March, Telesat announced multi-year agreements for Telesat Lightspeed connectivity services with Orange and ADN Telecom.

-

-

Backlog and Utilization

-

As of March 31, 2025, Telesat had contracted GEO backlog2 of approximately $1.0 billion.

-

-

-

As of May 5, 2025, Telesat had contracted LEO backlog2 of approximately $1.1 billion.

-

-

-

As of March 31, 2025, fleet utilization was 66.5%.

-

2025 Financial Outlook

(assumes an average foreign exchange rate of US$1=C$1.42)

For 2025, Telesat continues to expect full year:

-

Revenues to be between $405 million and $425 million;

-

Adjusted EBITDA1 to be between $170 million and $190 million on a consolidated basis. This reflects LEO operating expenses of between $110 million and $120 million, an increase from 2024 of between $38 million and $48 million; and

-

Capital expenditures (including both cash paid and accrued) to be in the range of $900 million to $1,100 million, virtually all of which is related to Telesat Lightspeed.

Telesat’s quarterly report on Form 6-K for the quarter ended March 31, 2025 has been filed with the United States Securities and Exchange Commission (SEC) and the Canadian securities regulatory authorities, and may be accessed on the SEC’s website at www.sec.gov and on the System for Electronic Document Analysis and Retrieval+ (SEDAR+) website at www.sedarplus.ca.

|

|

|

|