With the most serious restrictions of COVID-19 now generally in the rearview mirror, leading market intelligence firm Euroconsult estimates that maritime connectivity sectors have mostly recovered from the pandemic’s influence on supply chains and vessel activity at the end of 2022. According to Euroconsult’s forecasts, maritime satellite communication operators are expected to surpass $1.1 billion in revenues by 2032 at a 7% CAGR over the decade. Though some service providers will see a fall in their average revenue per unit (ARPU), total service revenues are expected to grow at a similar CAGR, falling slightly short of $3 billion by 2032.

In the latest release of its annual “Prospects for Maritime Satellite Communications” report, Euroconsult caveats the findings by warning that low-bandwidth services, predominantly for small merchant and fishing vessels, have not escaped the impact of the rising influence of inflation either and have seen an increase in data plan pricing. The report also makes reference to the war in Ukraine, which has led to geo-political effects on sectors like Offshore Oil and Gas, resulting in an increase in the number of support vessels being deployed to deal with demand-supply challenges.

High-bandwidth prices adhered to the expected downward trends for 2022, as accurately predicted in the company’s previous edition of the market intelligence report. This was particularly reinforced by the entrance of non-geostationary orbit (NGSO) constellation services, especially from Starlink, following SES’s O3b mPOWER, with OneWeb expected to join them in 2023/24.

“Starlink’s introduction created some waves in the market, especially in the latter half of the year, receiving a mixed reception,” says Vishal Patil, Senior Consultant at Euroconsult and Chief Editor of the report. “Whilst less cost-sensitive markets such as offshore rigs, large cruises, and leisure operators embraced it with open arms, small to medium merchant and fishing vessels remain watchful and are anticipated to trial out multiple services onboard before choosing the most suitable.”

Euroconsult estimates that the launch of maritime NGSO services is driving the adoption of very-small-aperture terminals (VSATs) in the sector, with 37,000 VSAT-equipped vessels at the end of 2022, the merchant shipping segment leading with 23,000 crafts.

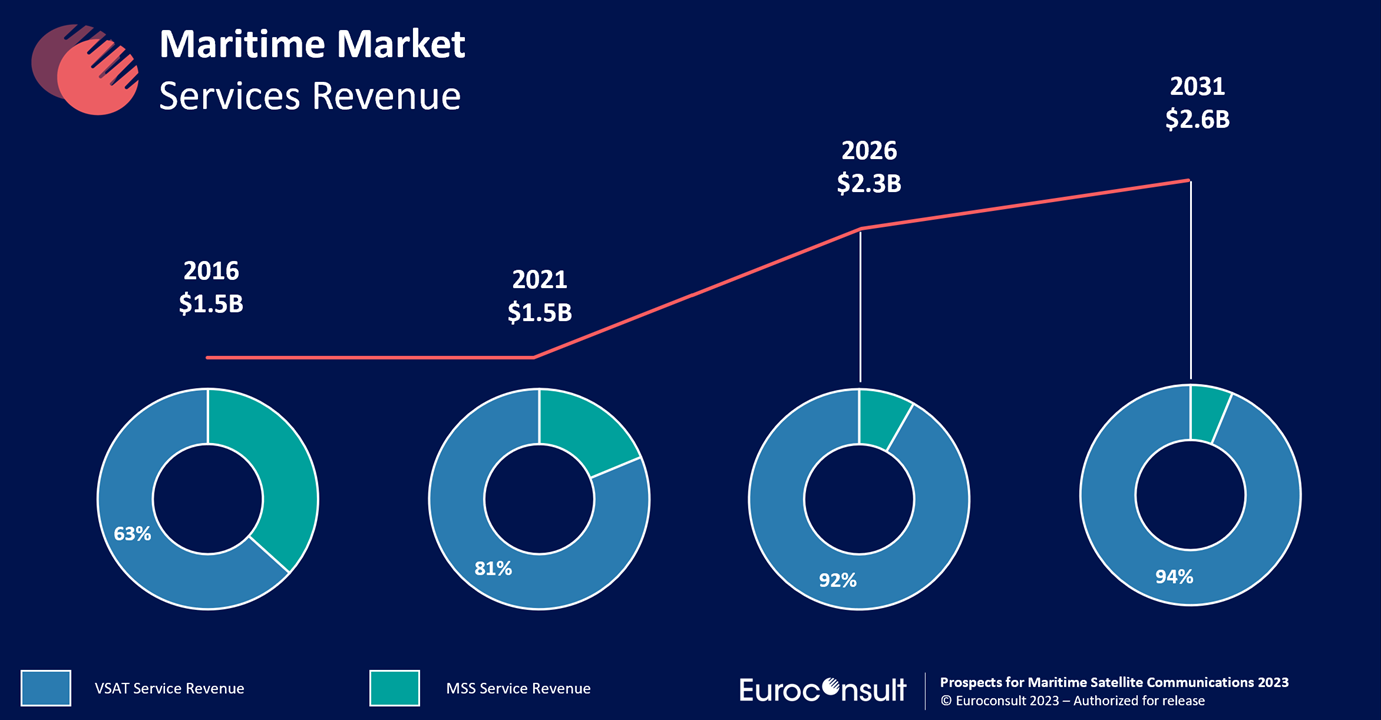

Maritime VSATs and associated service revenue evolution

Service revenues ($M)VSAT equipped vesselsUne image contenant texte, capture d’écran, cercle, diagramme Description générée automatiquement

After analyzing the initial response to the launch of new NGSO services, Euroconsult forecasts that the passenger segment will be hot on the tail of offshore and leisure verticals in adopting new communication technologies, with Starlink in particular seeing a positive response some other segments as well.

The firm thus expects a total of 90,000 VSAT-equipped vessels by 2032, with the associated bandwidth usage to grow twentyfold in 10 years from 65 Gbps in 2022 to 1.3 Tbps, mainly driven by the increased adoption of VSATs influenced by the availability of NGSO services for the maritime market.

“The cost of capacity will continue to fall given the increased supply provided by the new generation of geostationary very high throughput satellites (GEO VHTS) and NGSO satellites, pressurizing existing capacity providers also to lower prices,” added Patil.

Euroconsult’s “Prospects for Maritime Satellite Communications” report provides a review of key metrics of the Maritime Connectivity systems and services market, with a focus on satellite technologies, the impact of NGSO constellations, smart ships, and autonomous vessel concepts. The report contains a Strategic Outlook of global trends and forecasts by region and technology and is now available for order from the Euroconsult Digital Platform.

About the Report

The “Prospects for Maritime Satellite Communications” market intelligence report details the value chain of the Maritime Connectivity ecosystem with an analysis of VSAT service providers' market shares (network operator and retail level) and VSAT and MSS pricing trends. It provides detailed decade forecasts per region and technology of the five Maritime subsegments (Merchant shipping, Passenger, Leisure, Fishing, Oil & Gas), as well as key metrics at Year-End, Addressable market, Main market trends, Growth drivers, key service providers per subsegment. The report also has an Excel database with hundreds of important data points covering a spectrum of key parameters from the number of connected vessels per segment and per technology to service providers’ revenues and satellite operators’ revenues linked to satellite capacity allocated to Maritime Connectivity.

About Euroconsult

The Euroconsult Group is the leading global strategy consulting and market intelligence firm specialized in the space sector and satellite enabled verticals. Privately owned and fully independent, we have forty years of experience providing first-class strategic consulting, developing comprehensive market intelligence programs, organizing executive-level annual summits and training programs for the satellite industry. We accompany private companies and government entities in strategic decision making, providing end-to-end consulting services, from project strategy definition to implementation, bringing data-led perspectives on the most critical issues. We help our clients understand their business environment and provide them with the tools they need to make informed decisions and develop their business. The Euroconsult Group is trusted by 1,200 clients in over 60 countries and is headquartered in France, with offices in the U.S., Canada, Japan, Singapore, and Australia. www.euroconsult-ec.com