Executive Roundtable on Maritime and Energy Markets

by Bernardo Schneiderman

Los Angeles. Calif., October 3, 2018--The maritime market for the satellite communications industry continue to grow according to a recent report by NSR. NSR forecasts that the maritime atcom market will generate US$36 Billion in cumulative revenues through 2027. Driven by the migration of unconnected vessels to MSS, MSS customers to VSAT, and VSAT vessels to even higher throughputs, revenue growth will approach 7% from 2017 – 2027.

NSR also forecasts the major energy markets (oil and gas) to yield nearly US$1.6 Billion in retail revenues by 2027, up from US$900 million today. Requiring 80 transponders of FSS capacity and 3.5 Gbps of High Throughput Satellite (HTS) capacity spread across nearly 280,000 HTS, Fixed Satellite Service (FSS) and Mobile Satellite Service (MSS) in-service units for the global energy markets, the outlook for energy satcom connectivity is slowly improving.

NSR also forecasts the major energy markets (oil and gas) to yield nearly US$1.6 Billion in retail revenues by 2027, up from US$900 million today. Requiring 80 transponders of FSS capacity and 3.5 Gbps of High Throughput Satellite (HTS) capacity spread across nearly 280,000 HTS, Fixed Satellite Service (FSS) and Mobile Satellite Service (MSS) in-service units for the global energy markets, the outlook for energy satcom connectivity is slowly improving.

Although revenue growth remains in the low single-digits over much of the forecast period, by 2027 oil and gas (the largest opportunity by nearly any metric) will nearly double the size of both the mining and utility segments. The bottom line is that market instability is largely behind the energy markets, with a slow return to growth expected over the next ten years.

For the maritime market, there is “an insatiable demand for connectivity driving the market today,” said Brad Grady, NSR Senior Analyst and report author. “Broadband connectivity, with extremely high bandwidth demand found in some of the largest ocean-going cruise ships in the world, the impact of newer connectivity options in GEO and Non-GEO are having a profound impact on the market. FSS will still play a significant role in enabling a highly reliable, globally available network – but, the demand for higher throughputs combined with high vessel density in areas like the Caribbean are shifting network designs towards GEO & Non-GEO HTS options. At the lower end, new offerings in the MSS form factors are expanding the bottom of the market – bringing new vessels into service,” Grady added.

Offshore oil & gas will bear the brunt of these changing dynamics energy market, since end-user expectations are more throughput, with minimal pricing increases.

Maritime satcom markets will see demand grow to over 670 Gbps of throughput by 2027 – 26% from FSS and HTS GEO, and 74% from Non-GEO. As LEO comes online in the latter half of the forecast and SES’s O3b transitions to mPower in MEO, there is a huge amount of capacity coming online pushing prices down and unlocking additional demand in key markets. Merchant, leisure, and fishing markets will largely remain on GEO connectivity, as outside Super Yachts they do not yet have the significant levels of demand and/or budgets for the hundreds of Mbps per site from Non-GEO. Offshore faces stiff competition from terrestrial and ongoing pressures to keep budgets in-check, while the demand for passenger connectivity is ever-constant.

Overall, with another US$ 2.5 Billion in revenue growth between 2017 & 2027 and another 45,000 vessels adopting broadband capability over the next ten years, there is a strong demand for throughput in all orbits, frequencies, and form-factors.

To give an update on these two key markets segment we invited executives from Service Providers and Antenna Manufacturers for a virtual round table discussion. The participants are: Ronald Spithout, President of Inmarsat Maritime; Paul Comyns, VP Global Marketing, Intellian; Wouter Deknopper, Vice President and General Manager, Maritime Line of Business, Iridium; Richard Elson, Vice President, Global Energy, ITC Global; Tore Morten Olsen, President Maritime, Marlink.

Satellite Markets (SM): What satellite communications services or products are you now offering for the maritime and oil and gas markets?

Inmarsat: Inmarsat was set up in 1979 by the International Maritime Organization (IMO) to enable ships to stay in constant touch with shore or call for help in an emergency but has since evolved into a publicly-listed, multi-sector communications service provider which today offers connectivity via 13 operational geostationary satellites.

Nevertheless, over 40% of Inmarsat’s revenues are still derived from the maritime and offshore industries, where it offers the broadest portfolio of mobile voice, data solutions and value-added communications services available. Thousands of vessels rely on its end-to-end service availability and its 99.9% global coverage for operational communications and safety services. Connectivity options include voice calling via handheld satellite phones, broadband internet devices, and specialist terminals and antennas fitted on ships.

Inmarsat services are available directly or via its worldwide network of independent Distribution Partners and Service Providers. The portfolio includes:

— FleetBroadband: Inmarsat’s flagship service for the maritime and offshore sectors, which provides always-on voice and broadband data coverage using L-Band for multiple user operational and crew communications.

— Fleet Xpress: Fleet Xpress exploits Ka-band high data speed capability available via new generation Global Xpress satellites, combined with the proven reliability of unlimited L-band back-up via FleetBroadband to enable the digitalization of the maritime and offshore sectors.

— Fleet One: specifically designed to meet the low data usage demands of smaller, occasional or seasonal users when they move out of VHF or GSM coverage areas, Inmarsat offers two Fleet One service plans to put satellite broadband in the reach of any size of vessel.

— FleetPhone: a low-cost, maritime satellite phone service for use when users are beyond the range of land-based networks.

— Fleet Secure: a suite of cyber security services including a Unified Threat Management (UTM) service, an Endpoint protection service and an Awareness service that helps train seafarers on the dangers of cyber threats at sea.

— Fleet Data: Inmarsat’s new Internet of Things (IoT) service to enable ship owners and managers to access and analyse real-time onboard data more efficiently using a ship’s onboard Voyage Data Recorder (see below).

— Fleet Safety: Inmarsat’s next-generation safety at sea service, which was formally recognised as a new service to support the Global Maritime Distress and Safety System (GMDSS) by the IMO Maritime Safety Committee in May 2018. Delivered over FleetBroadband/Fleet One, Fleet Safety offers free 505 calling service for vessels and incorporates the web-based messaging services for mariners SafetyNET II and RescueNET in one platform.

— Fleet Media: Inmarsat’s entertainment service for crew includes Hollywood movies, international films, TV box-sets, and international news and sports, anywhere at sea. The service can be watched via laptop, computer or smartphone on board.

Intellian: The latest product from Intellian that targets the energy sector is the new v240MT, our 2.4m tri-band antenna system. The v240MT can operate on C, Ku, or Ka bands with either GEO or MEO satellite constellations, ensuring future-proof communications for the oil and gas market. This new tri-band antenna system will enable operators to switch networks, frequency bands and constellations depending on where the rig may be deployed. It is a fully flexible solution for any offshore installation.

Iridium: Iridium has many partners and customers within the maritime and oil and gas markets. Specifically, for maritime customers, including oil rigs, we find that many end users rely on Iridium’s network for a range of uses, such as preventative vessel maintenance and monitoring, diagnostics, crew communications and internet capabilities. A variety of Iridium products and services can support these needs and markets including (but not limited to) Iridium’s maritime broadband terminal, called Iridium Pilot®, Iridium’s latest satellite phone, called the Iridium Extreme® and Iridium’s Internet of Things (IoT) transceivers, including the Iridium 9603®. While working on oil rigs, we find Iridium’s aviation products are popular since helicopters are a primary mode of transportation. Iridium’s aviation product line, including the Iridium Certus terminal called FlytLINK developed by Thales, is the only line of satellite solutions that can provide connectivity under a moving rotor blade. All Iridium products are small in form factor, rugged and able to provide reliable satellite connectivity anywhere in the world, including Polar regions.

ITC Global: ITC Global recently rolled out new features to our crew welfare platform, ITC Crew LIVE, adding Video On-Demand to the service. Crew LIVE is an advanced, multi-purpose connectivity and entertainment solution that enables companies to modernize welfare programs for their remote staff and crews while meeting the bottom-line needs of their business.

This platform offers a whole new approach to remote connectivity, with reliable hotel-style wireless internet direct to personal devices for access to top-of-line content, including streaming entertainment services, all types of social and digital media, and more. This is especially necessary in remote environments where limited connection to the outside world can have a direct impact on crew welfare, causing hardship for remote site personnel and their loved ones. Crew LIVE enables remote staff to stay connected with friends and family and keep up with personal business during off hours while away at work for extended periods of time.

The solution can be delivered on a dedicated satellite antenna, separate from corporate network communications, which ensures that business and personal use are kept entirely separate to eliminate security concerns and competing network priorities. This provides the best user experience for everyone during work and leisure time.

Additionally, ITC Global continues to augment Crew LIVE and its crew welfare offerings for the broader energy and maritime market tailored to meet customers’ demands and needs. ITC Global is also working to augment Crew LIVE to provide improved overall system management to ship owners. This will allow for more effective crew welfare management on the customer end, enabling ship operators to manage their crew’s data, review and manage data throughputs and address abusers on the network. While many of our Crew LIVE customers prefer to rely on ITC Global for all aspects of their crew welfare platform, some vessel operators are looking for solutions with higher levels of ownership.

Marlink: Our extensive C- and Ku-band network is integrated with L-band Mobile Satellite Services and next generation Ka-band High Throughput Satellite services – Inmarsat FleetXpress and Telenor Satellite’s Thor 7 – ensuring highly flexible and reliable services globally. We take a technology-agnostic, multi-band approach to our portfolio, ensuring we are able to meet all customer specifications and operational areas. We provide full global coverage on the widest spread of satellites, including from Inmarsat, Intelsat, Iridium, SES and Telenor Satellite. Through our partnerships with all major satellite network operators, we deliver the bandwidth where and when it is needed, supporting thousands of vessels across all maritime verticals to access digital applications that can help them to operate safer and more efficiently.

In parallel with our extensive satellite services offering, we also provide a wide portfolio of Value Added Services, including our Cyber Guard IT security portfolio which has recently been updated with a unique, advanced maritime Cyber Detection service. The Cyber Guard portfolio enables Marlink customers to protect, detect and resolve any cyber-threat through a holistic combination of network resilience and redundancy, dedicated maritime cyber-security technology and maritime Security Operation Center (SOC) experts. Cyber Detection, the latest addition to Cyber Guard, monitors all outbound and inbound network traffic around the clock and enables customers to view threats affecting their vessels through an intuitive, web-based dashboard.

Our XChange centralised communications management system also brings with it unique opportunities for our customers, such as a new cloud-based file transfer system and a leading range of crew welfare focused technology, such as Bring Your Own Device and a cutting-edge telemedicine solution.

SM: Do you have any plans to use flat antennas in your portfolio of products and services to address this market in the short or long term?

Inmarsat: For commercial vessels of over 500gt, terminals used for maritime applications need to be approved by the International Maritime Organization, so flat panel antennas are still a few years away from adoption in the commercial maritime market.

However, Inmarsat is fully cognizant of developments in flat antennas and has type approved Paradigm’s Swarm45 terminal for use with for Inmarsat Global Xpress worldwide across multiple platforms and missions. Inmarsat also entered a strategic technology development agreement with Isotropic Systems earlier this year to look at developing state-of-the-art antennas for existing and future Global Xpress satellites.

Intellian: Currently Intellian, as a leading technology provider within the maritime VSAT sector, is monitoring the flat panel systems and technology available.

Iridium: Iridium is in the process of launching its next-generation L-band broadband solution called Iridium CertusSM, that will run over terminals with phased-array antennas. Unlike existing satellite terminals in the market, Iridium Certus antennas are extremely light-weight (<3Kg) and small in form factor (approx. 30cm in diameter and height). Today, there are two value-added manufacturers (VAMs) who have Iridium-certified terminals to support the service. For the maritime market, Cobham’s SAILOR 4300 terminal and Thales’ VesseLink and MissionLink terminals, will deliver Iridium Certus to customers anywhere in the world. For the first time, the maritime market will have a choice when it comes to broadband communications, with a solution that is a reliable, high-speed and cost-effective option, offering capabilities and flexibility that do not exist in the marketplace today.

ITC Global: ITC Global, and parent company Panasonic, are looking into various antenna technologies to support both short- and long-term initiatives to meet the expanding VSAT network and their customers’ requirements. For the mass commercial market, our expectation for any flat panel solution would be to match its parabolic competitor in size, price and most importantly, performance. While performance levels may not be at the point to meet customer’s growing operational requirements, we anticipate that as the technology progresses, we should see flat panel innovations come closer to meeting expectations.

Marlink: Our portfolio is 100% technology agnostic, so if there is a use case from specific customers then flat panel antennas can certainly be considered. At the moment the technology is still developing, but in the long term we see that certain segments, yachts and superyachts for instance, may be most suited to flat panel antennas.

SM: In the maritime and oil and gas market, where do you see growth for the next 2-5 years in specific market segments or regions?

Inmarsat: Inmarsat recently published original research covering attitudes and intentions towards digitalisation in the global supply chain, and its findings point strongly towards accelerating uptake for high bandwidth services, such as Fleet Xpress.

The Inmarsat Research Programme 2018 report is based on 750 interviews and included 125 maritime respondents. One of its most compelling findings was that average expenditure per business on IoT-based solutions will amount to US$2.5 million over the next three years. The finding points towards strong growth in demand from the maritime sector for high speed data connectivity ship to shore connectivity over the coming 2-5 years that will enable digitalization in fleet management and ship operations.

In part, this demand will be driven by the need to control costs, a trend that is already demonstrated by 57% of participants saying they are either using or trialling route optimisation software as part of their vessel management. However, regulation is also providing a prompt for adoption. With rules tightening on emissions from ships, 65% of respondents say they already use IoT-based solutions to monitor fuel consumption, rising to the 100% by 2023.

Inmarsat also expects continuous growth in use of its FleetBroadband services as current and new users migrate up the data chain. In addition, Inmarsat expects to secure significant market share among lower data users as a result of its newly flexible package of tariffs made for Fleet One, targeting the needs of fishing and leisure clients in key regional markets.

Intellian: Growth will come from all regions, as we see a positive uptick in the energy market. As a hardware provider we anticipate that demand for multiband antennas will increase, and also with the increase in day rate chartering there will be a need for more flexible skid-based solutions.

Iridium: In the next 2-5 years, we anticipate growth in the digitalization of shipping and increase in the automation of ship/vessel processes. Iridium’s network is an ideal solution to support this new digital era, since it is the only network that can enable connectivity anywhere on the planet. Regarding regions, we have seen an increase in demand for Arctic and Polar communications, and as the only network able to deliver connectivity in those areas, we anticipate seeing some gains there for not only the maritime market, but in additional industry verticals like land-mobile, IoT and aviation.

ITC: We’re seeing that the oil and gas sector is beginning to move past recovery and refocus on project investments. ITC Global expects to see growth in both technology and automation. The latest analyst reports point to the world’s energy companies moving to start to approve an estimated $300 billion in spending on large projects in 2019 and 2020, an amount greater than the combined spending during the previous three years from 2015 to 2017.

Many customers are shifting from a cost-savings approach to an investment and execution approach. There are certainly still expectations for cost-effective solutions, but that comes in the form of efficiencies and optimization from technology and digitization implementations. We’ll see a push toward greater savings and higher productivity through vessel automation, which in turn is driving increases in communications requirements.

A continued laser focus on HSE is also now driving digitization requirements, and we’ll certainly see this grow for offshore operations. In some cases, we’re seeing this in the form of a reduction in offshore personnel, with more equipment and offshore processes being managed and operated by staff back at corporate locations. For other clients, we’re seeing this take shape in the form of more monitoring, especially for assets that are nearing the end of their lifecycle. These improved production and safety objectives are being addressed through the implementation of sensor technologies and cloud-based data analytics – resulting in major increases to data needs. With these changes, more offshore companies are partnering with reliable service providers for connectivity, a partnership that is enabling companies to reduce downtime, increase asset optimization and improve operational efficiency.

Crew welfare is also a growing necessity for companies as they try to provide the same connectivity to their crews offshore as they are used to having onshore. However, these innovations can be secondary to cost in some segments of the maritime market.

Marlink: The cruise market leads the way in demand for bandwidth and we expect the growth here to continue, in part driven by the need to give customers high quality Internet and social media access. Cruise companies also benefit from the free marketing that this provides. There is also a growing trend in the cruise sector to develop services based on the data that guests generate on board.

We see a very significant trend towards digitalisation in merchant shipping, where leveraging connected technologies can deliver more operational efficiency. For instance, engine monitoring can contribute to reductions in bunker costs and emissions, while enabling a more efficient maintenance and service process. Data has to be available ashore to realise efficiencies though, making satcom a vital component in the on-going development of so-called ‘smart ships’, and in the future, autonomous ships.

We also see growth in the commercial fishing sector, where crew welfare improvements and regulatory issues demand more reliable connectivity, while the leisure sector continues to grow, especially within superyachts as owners and charter companies simply want the most powerful communications on board. We are also seeing a slow recovery in in the offshore oil & gas sector, reflected by the re-activation of our services on a number of previously laid-up support vessels.

SM: Do you now provide, or have any plans to provide, value-added IoT services for the maritime and oil and gas sectors?

Inmarsat: In September 2018 Inmarsat launched Fleet Data, a new Internet of Things (IoT) service to enable ship owners and managers to access and analyse real-time onboard data more efficiently and help accelerate the adoption of IoT across the maritime industry.

Developed in partnership with Danelec Marine, Fleet Data will record data from the onboard Voyage Data Recorder (VDR), and other vessel sensors, pre-process that data, and upload it to a central (cloud-based) database equipped with a dashboard and Application Process Interface (API). This will allow ship owners and managers to identify equipment issues and failures quickly and easily, and seamlessly link 3rd party applications to monitor vessel performance and fuel efficiency.

Fleet Data is the only service that offers a highly reliable, dedicated bandwidth-inclusive service, on a sensor agnostic platform that allows ship owners and managers to access the full potential of IoT and efficiency-enhancing vessel performance applications, in real time. Trials are due for completion this month aboard two ships operated by a leading ship manager, which have been verifying performance over a six-month period by relaying data collected through fuel optimisation software.

Laboratory tests with other applications to run over Fleet Data, such as ECDIS chart updates on the FleetBroadband service, are also underway in Ålesund, Norway, the home of Inmarsat’s research and development activities for the commercial maritime sector.

Today, all passenger and all cargo ships of 3,000gt and above must carry a VDR under the Convention for Safety of Life at Sea; able to interface with input signal sources, recording/playback equipment, and power supply/reserve power.

Building on its Fleet Xpress service, Inmarsat is also already involved in a number of application and IoT projects in the maritime sector as part of its Certified Application Provider programme working with companies such as Rolls-Royce and Samsung Heavy industries to provide energy management and remote monitoring applications.

Intellian: These kinds of services would generally be provided as an extra value-add from a service provider rather than from an antenna hardware manufacturer like Intellian.

Iridium: Iridium’s satellite-IoT products and services play a role in every vertical we serve, including the maritime and oil and gas markets. Even today, we see a lot of IoT cross-over in the maritime business, especially for applications like vessel diagnostics and preventative maintenance. For example, large shipping companies use Iridium’s satellite-IoT devices to track and monitor deployed assets and can even use the same technology to track cargo, making sure it arrives to its final destination on time and in-tact. With respect to the oil and gas markets, a great example of a popular partner application is the Osprey TMC solution by ASE, which is used on oil rigs to monitor air quality and control hydrogen sulfide (H2S) levels, thereby ensuring crew’s health and safety.

We anticipate seeing an increase in IoT applications for mariners, especially with the launch of Iridium Certus. The latest IoT product, called Iridium Edge®, can be used by any end user within any vertical to extend the reach of its terrestrial-based IoT solutions. The device can be rapidly deployed for fleet management, telematics and other remote monitoring applications, whether on land or at sea, anywhere in the world.

ITC: ITC Global designs and delivers the most robust, comprehensive network solution to ensure that the client’s network can manage all the desperate IoT applications and systems being implemented to optimize operations. New and upcoming partnerships enable ITC Global to tailor services based on customers’ needs by introducing additional capabilities and providing fully reliable IT and engineering solutions.

As more energy and maritime companies start to realize the benefits data analysis can have on business, we’ll see an increase in the implementation of IoT technologies. ITC Global’s experience in navigating new technologies makes it the ideal partner for companies looking to expand network capabilities for short- and long-term operations. With the added depth of Panasonic’s own business model and technology review process, ITC Global is examining a wide breadth of Panasonic technologies, including remote monitoring and sensing, real-time video data analytics for efficient offshore operations and more. As companies in these markets begin re-evaluating their investment plans, improving efficiency in operations and maintenance will be key to staying ahead of the game. ITC Global has both the satellite network and industry expertise to help these companies succeed.

Marlink: IOT is a broad term but certainly, Marlink is already operating in this field by providing machine-to-machine connectivity. To develop this further, as part of our Smart Connectivity strategy we seek to support new partners and applications to work together to enable more digitalisation and business efficiency.

SM: Considering the Ku and Ka bands and the new constellations of LEO satellites, how are you addressing this new trend in the maritime and oil and gas market?

Inmarsat: Inmarsat is facing an intensification of competition in the maritime space, due to the arrival of new L-band capacity and strategies to attract customers away from existing L-band services to the greater bandwidth offered via Ku-band.

Nevertheless, a recent study by Euroconsult verified that Inmarsat has been the fastest growing provider of maritime VSAT services in the first half of 2018, with 60% of all new maritime VSAT deployments being Fleet Xpress.

Inmarsat also commands an 85% market share of maritime L-band revenues and a 21% share of maritime VSAT revenue – a figure which has also been verified by Euroconsult. Inmarsat will redouble its efforts to maintain its share of the L-band segment, with an imminent doubling of FleetBroadband data rates via a firmware upgrade expected to bring significant rewards.

Two next-generation Inmarsat-6 satellites are also due to be launched in 2020 and 2021 which will offer hybrid Ka-band/L-band capacity, whose arrival will sharpen Inmarsat’s competitive offering across the Fleet Xpress and FleetBroadband segments.

Intellian: Intellian was the first to deliver an antenna system that can switch between different bands and different constellations on the fly with the new v240MT tri-band antenna solution combined with the Intelligent Mediator device. This antenna system is well proven at sea with many installations operating today providing record-breaking data throughput speeds in Gbps ranges

Iridium: In today’s landscape, we find that often times end users are relying on both Ku/Ka and L-band networks for a well-rounded on-board connectivity suite, as they complement each other. With the new LEO constellations being proposed and launched, none include a cross-linked architecture, which is key to enabling reliable connectivity anywhere on the planet (like Iridium). For these new constellations, it will be difficult to properly service the maritime market over open oceans since there are no ground stations. Regarding how Iridium is addressing this trend, the launch of new products and services, Iridium Certus, will be competitive and will meet the needs of all mariners and oil and gas customers. It is anticipated to fill an existing gap in the marketplace, with a solution that is global, affordable, flexible and most importantly, reliable. Iridium Certus will be the fastest L-band satellite broadband solution, and once commercially available, will deliver next-generation capabilities over small form factor antennas and terminals, making it a desirable option for customers of all sizes.

ITC: ITC Global is committed to providing solutions that best fit its customers’ needs. We leverage our extensive network portfolio to support the diverse needs of our customers, delivering Ku-band, Ka-band and C-band systems as needed based on what is best suited for a customer’s specific requirements. ITC Global looks to provide the lowest cost-per-bit for its customers without sacrificing the quality of the services it provides.

When it comes to the equipment requirements and additional antennas needed to work with LEO satellites, the impact of additional costs and coverage changes must be considered when suggesting this as a solution for customers. While LEO satellites may have advantages for some operations, ITC Global is conscious of the costs required to implement this change. In partnership with Panasonic, ITC Global is studying these systems and the value they can offer for our global mobility network.

Marlink: With maritime satcom, there is no ‘one size fits all’, which is why we are focused on delivering a wide orbital spread using satellites from all major operators. Through this we can meet any requirements from our customers. We continue to add new satellites and beams, even offering double and triple redundancy to ensure that we can deliver the amount of bandwidth needed. So, in the context of LEO constellations, we are watching very closely. We see that the low-latency could have some benefit in specific maritime applications but generally, the influx of new capacity will only be a positive thing for Marlink customers and the maritime industry.

As we can extract from the round table the market for Maritime has more potential of growth comparing with the Oil & Gas that starting slowing coming back. But to give another flavor Euroconsult another Market Research Company provide the following profile for this market.

Smart shipping is some of the major factors pushing maritime operators to install the latest generation of satellite systems on their vessels. Autonomous shipping, performance monitoring, fleet management and cybersecure applications, brought by an increasing number of IoT-connected and sensing devices will drive capacity demand in the next decade.

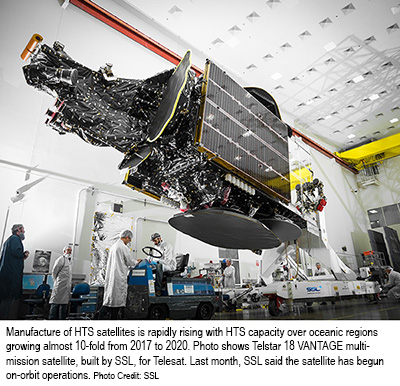

For the maritime market, if all satellites are launched as planned, the total available HTS satellite capacity over oceanic regions will grow almost 10-fold from 2017 to 2020, to cater to the ever-growing demand. The hardware, such as receiving antennas and modems, is also evolving rapidly; smaller, lighter, and more efficient antenna systems are gaining traction as the industry continues to evolve.

Euroconsult forecasts that the maritime satcom market (both MSS and VSAT) will grow to more than 500,000 terminals in 2027 as compared to 337,300 terminals in 2017. Total revenue for satellite operators should grow from $953 million in 2017 to $1.6 billion by 2027, a 10-year CAGR of 5.2%. The revenue for maritime service providers is estimated to grow from $1.8 billion in 2017 to $2.9 billion in 2027 with a 10-year CAGR of 5.3%.

Consolidation in the past several years has enabled leading VSAT service providers to gain market share and the five largest companies hold 90% of the market. Competitive pressure is increasing; the development of new VSAT terminal installation facilities and the democratization of the technology are lowering entry barriers for regional service providers, especially in the Asian and Middle East markets. Still, greater competition combined with the need to improve profit margins and leverage economies of scale will favor further integration and consolidation in the value chain.

---------------------------------

B. H. Schneiderman is the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com.