Brazil: Latin America's Leading Satellite Market

by B. H. Schneiderman

Sao Paolo, Brazil, October 7, 2011--With the sluggish mature markets of North America and Europe, the focus has been on emerging regions such as Latin America which has been experiencing a major boom in the last few years. The demand for satellite services in Latin America is only expected to grow exponentially in the next few years with the Soccer World Cup in 2014 and the Olympics in 2016 slated to be held in Brazil.

Sao Paolo, Brazil, October 7, 2011--With the sluggish mature markets of North America and Europe, the focus has been on emerging regions such as Latin America which has been experiencing a major boom in the last few years. The demand for satellite services in Latin America is only expected to grow exponentially in the next few years with the Soccer World Cup in 2014 and the Olympics in 2016 slated to be held in Brazil.

Brazil is one of the fastest growing economies in the world along with Russia, India and China (the so-called BRIC countries). In 2010 Brazil’s GDP growth was 7.5% and the forecast for 2011 is 4%.

Currently there is a shortage of satellite capacity in Brazil. The gap between supply and demand for satellite capacity in Brazil has seen domestic and international satellite operators scrambling to meet existing and future demand.

Given the shortage of capacity, the Brazilian government decided this year through the regulatory agency Anatel (the Brazilian equivalent of the FCC) to open the bidding process for four orbital satellite positions last August 23. The interested companies were allowed to participate in the bidding process as a consortium, but the same company or a subsidiary or affiliate of its parent company could not be granted more than two orbital slots. The right to operate is valid for 15 years, renewable for another 15 years. The winning bidders will have four years to fill up the orbital slot with an operational satellite.

In the case of orbital positions already assigned to Brazil by the International Telecommunications Union, 25% of the capacity of the satellite is earmarked for domestic use and in the case of positions not yet assigned, the requirement for domestic use goes up to 50%. In both cases, the satellites need to cover 100% of the Brazilian territory. The minimum price set for each orbital position was US$ 2.4 million.

Last August 30, Anatel received bids for the four orbital slots totaling that US$ 154.9 million. Anatel had qualified seven companies that participated in the bidding process: Eutelsat, Hispamar (owned by Hispasat), Intelsat, SES, SKY Brazil, StarOne and Hughes Americas.

HNS Americas Communications Inc. (owned by Hughes which was recently acquired by Echostar) was reported to have bid US$ 88.3 million for the first orbital slot in 45 degrees west—a staggering sum for one orbital slot that surprised many seasoned industry observers. In addition to this position, Hughes also got the winning bid for the fourth orbital slot at 68.5 degrees west, at a cost of US$ 21.4 million.

Star One SA (owned by Brazilian telco Embratel and controlled by Mexican conglomerate Telmex) won the bid for the second orbital slot at 70 degrees west, for US $ 22.5 million. Star One SA also offered the best bid for the third orbit slot at 84 degrees west, for the amount of US$ 22.5 million. During the bidding process some analysts speculated that StarOne might appeal against Hughes’ second slot because of the possibility of interference between the position of 68.5 degrees West acquired by Hughes and the position of 70 degrees acquired by StarOne.

Beside these new commercial satellites, the Ministry of Communications of Brazil just announced in August the 2012-2015 Plan with a budget of US$ 433 million to launch two or three satellites to be defined later for the government program to provide capacity for the ministries of Defense and Education (for Internet access to schools and remote regions of the country). This project was on hold during the previous administration due to internal discussions on who will manage the program. With the budget already allocated by the telecom holding company owned by the Brazilian government, Telebras, the government revived the satellite project at the end of 2010 with the target implementation in the next four years.

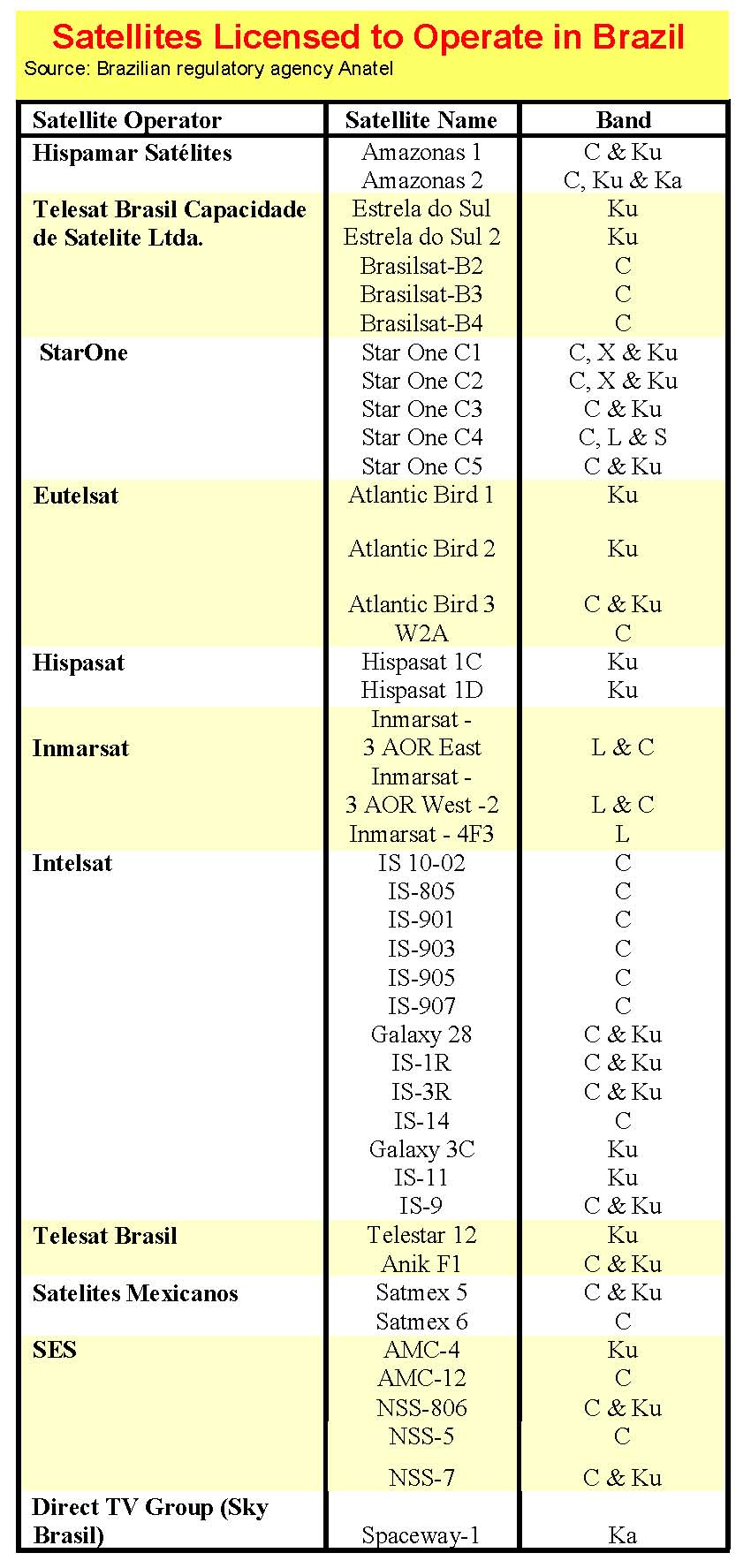

Currently the Brazilian telecom regulatory agency, Anatel, lists 44 satellites with license to operate and provide services in the Brazilian territory. Among these include 12 domestic (Brazilian-owned and operated) satellites and 32 foreign satellites.

Jurandir Pitsch, vice president of market development for Latin America of SES said during the recent Broadcast and Cable conference in Sao Paolo that SES is planning to expand capacity for the Brazilian market with the launch of SES-4 in the fourth quarter of 2011 replacing NSS-7 for the 22 degrees west and relocating the NSS-7 to the orbital slot of 20 degree west continuing providing services until 2016. Additionally SES plans to launch another satellite in early 2013, SES-6, which will replace NSS-806 located at 40.5 degrees west expanding the current six Ku-Band transponders with 48 new transponders in Ku-Band beside the continue coverage with C-Band Transponders. To support the broadcast market in Brazil, SES is launching a multi-region satellite SES-5 in 2012 that will provide coverage in Europe, Africa and Latin America offering capa-city to broadcasters to transmit signals from Brazil to Europe and Africa and vice-versa.

Jurandir Pitsch, vice president of market development for Latin America of SES said during the recent Broadcast and Cable conference in Sao Paolo that SES is planning to expand capacity for the Brazilian market with the launch of SES-4 in the fourth quarter of 2011 replacing NSS-7 for the 22 degrees west and relocating the NSS-7 to the orbital slot of 20 degree west continuing providing services until 2016. Additionally SES plans to launch another satellite in early 2013, SES-6, which will replace NSS-806 located at 40.5 degrees west expanding the current six Ku-Band transponders with 48 new transponders in Ku-Band beside the continue coverage with C-Band Transponders. To support the broadcast market in Brazil, SES is launching a multi-region satellite SES-5 in 2012 that will provide coverage in Europe, Africa and Latin America offering capa-city to broadcasters to transmit signals from Brazil to Europe and Africa and vice-versa.

Intelsat plans to put into orbit by the end of 2013 two more satellites covering Brazil: IS-21 and IS-27. The first is scheduled for the second quarter of 2012 and will replace the IS-9 at the orbital position of 302 degrees east. The IS-27, in turn, will occupy the position of 304.5 degrees east and is expected to be launched in 2013. These satellites will increase the number of transponders in C- and Ku-band provided by the company for services in Brazil.

Spanish operator Hispasat also announced September 7 that it has contracted with Arianespace for the launch of the Amazonas-3 satellite sometime in the fourth quarter of 2012 or early 2013. Amazonas-3 will be built by Space Systems/Loraland will have 33 Ku-band transponders, 19 C-band transponders and nine Ka-Band broadband spot beams. The satellite will replace the Amazonas-1 satellite, providing a range of broadband telecommunications services to the Americas and Europe from the 61 degrees west orbital position.

These new satellites will have their hands full meeting the insatiable demand for DTH, Distance Learning, Government, Broadband and other applications for the Brazilian market.

Amazonas-3 will be built by Space Systems/Loraland fitted with 33 Ku-band transponders, 19 C-band transponders and nine Ka-band broadband spotbeams. The satellite will replace the Amazonas-1 satellite, providing a range of broadband telecommunications services to the Americas and Europe from the 61 degrees West orbital position.

These new satellites will have their hands full meeting the insatiable demand for DTH, Distance Learning, Government, Broadband and other applications for the Brazilian market.

-----------------------------------------

B. H. Schneiderman is the Principal of Telematics Business Consultants. He can be reached at : info@tbc-telematics.com